From cheaper homes to free-flowing pensions, boomers built fortunes — now holding over half of U.S. wealth despite being one-fifth of the population.

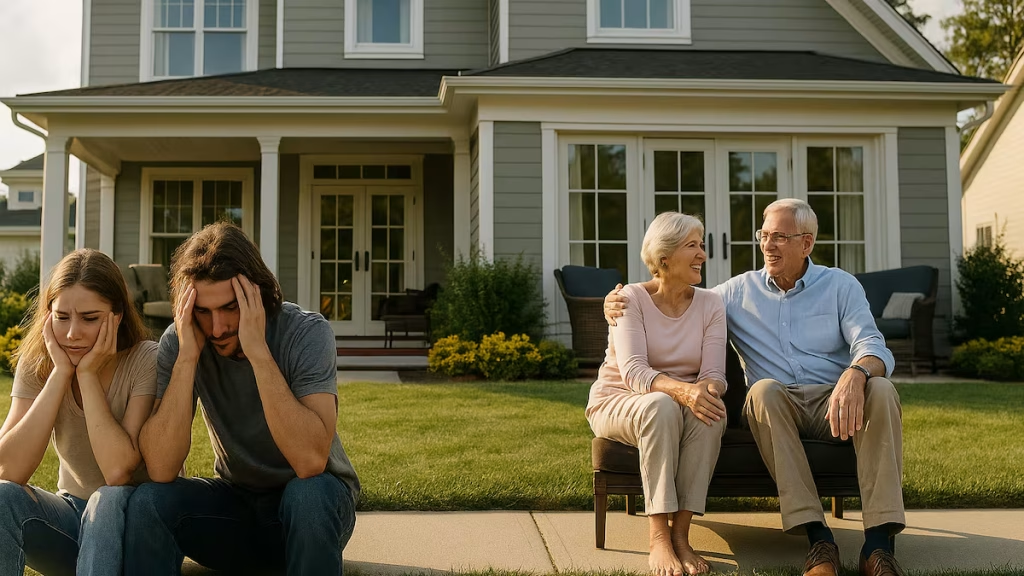

It’s a common complaint from young adults these days — the oldies had it easier financially, in particular the baby boomers, those born between 1946 and 1964.

And while it’s never going to be a perfect apples-to-apples comparison, because the U.S. economy, technology, and culture have changed dramatically since the postwar years, in certain key areas, life really was financially easier for many Americans in the baby boomer generation. Here’s a look at where things could be dramatically better for people back then.

Affordable housing market

The cost of housing is probably the biggest complaint from the under-35s, who are Gen Z (born 1995 to 2010) and young millennials (born 1981 to 1995). During the 1970s and 1980s, the median home price was roughly two to four times the median household income, compared to six to eight times today.

Even accounting for interest rate fluctuations, the combination of lower prices, looser lending standards, and smaller required down payments meant more young families could buy homes early. Given that a home is usually the biggest asset an individual or family owns, this change makes a stark difference. You can’t make up for housing effectively costing three times as much by foregoing lattes and avocado toast. And this shift had a huge long-term effect, allowing boomers to build decades of equity — a wealth-building tool far harder to access for today’s first-time buyers.

Pension plans were robust

In the boomer heyday, defined-benefit pensions were common. These plans guaranteed retirees a fixed income for life, usually based on years of service and final salary. Today, pensions have largely been replaced by defined-contribution plans like 401(k)s, shifting both the investment risk and the responsibility for saving onto individual workers.

Reduced education costs

College tuition was a fraction of today’s prices, both in absolute dollars and relative to income. Public universities were heavily subsidized by state governments, administrative costs were leaner, and student debt was rare. Today’s ballooning tuition is driven by reduced public funding, administrative bloat, and an amenities arms race, leaving most graduates with significant loans.

Affordable healthcare

Healthcare costs have risen far faster than wages over the past 50 years. In the boomer era, medical technology was less advanced but also less expensive, insurers were more tightly regulated, and employer-provided plans covered more at a lower out-of-pocket cost. Prescription drugs were generally cheaper, hospital stays cost far less, and the growth of expensive, long-term treatments was still decades away — all of which kept total healthcare spending lower as a share of household budgets.

Favorable job markets

The postwar U.S. economy was booming. Manufacturing jobs were plentiful, unions were strong, and global competition was limited. Workers could expect more job security, clearer career ladders, and wages that kept pace with productivity. Today’s job market is more globalized, more automated, and more precarious — with many benefits and protections eroded.

Is it all a disaster for youngsters?

It’s not all bad news. Many goods are cheaper, safer, and better than their 1960s or ’70s counterparts. Cars now last longer and come with advanced safety features, home appliances like boilers and washing machines are more efficient, air travel is far more affordable, and consumer electronics have transformed daily life. Manufacturing advances and global trade have made everything from clothing to toys to flat-screen TVs accessible to far more households than in the boomer era.

But there is no doubt, that is some major areas, the boomers got lucky. A stark example of that is just how much wealth that generation is sitting on: some $78.55 trillion, or 51.8% of total U.S. household wealth, while they represent just 20.6% of the U.S. population.